2022 annual gift tax exclusion amount

This exemption is per. For 2022 the annual gift exclusion is being increased to 16000.

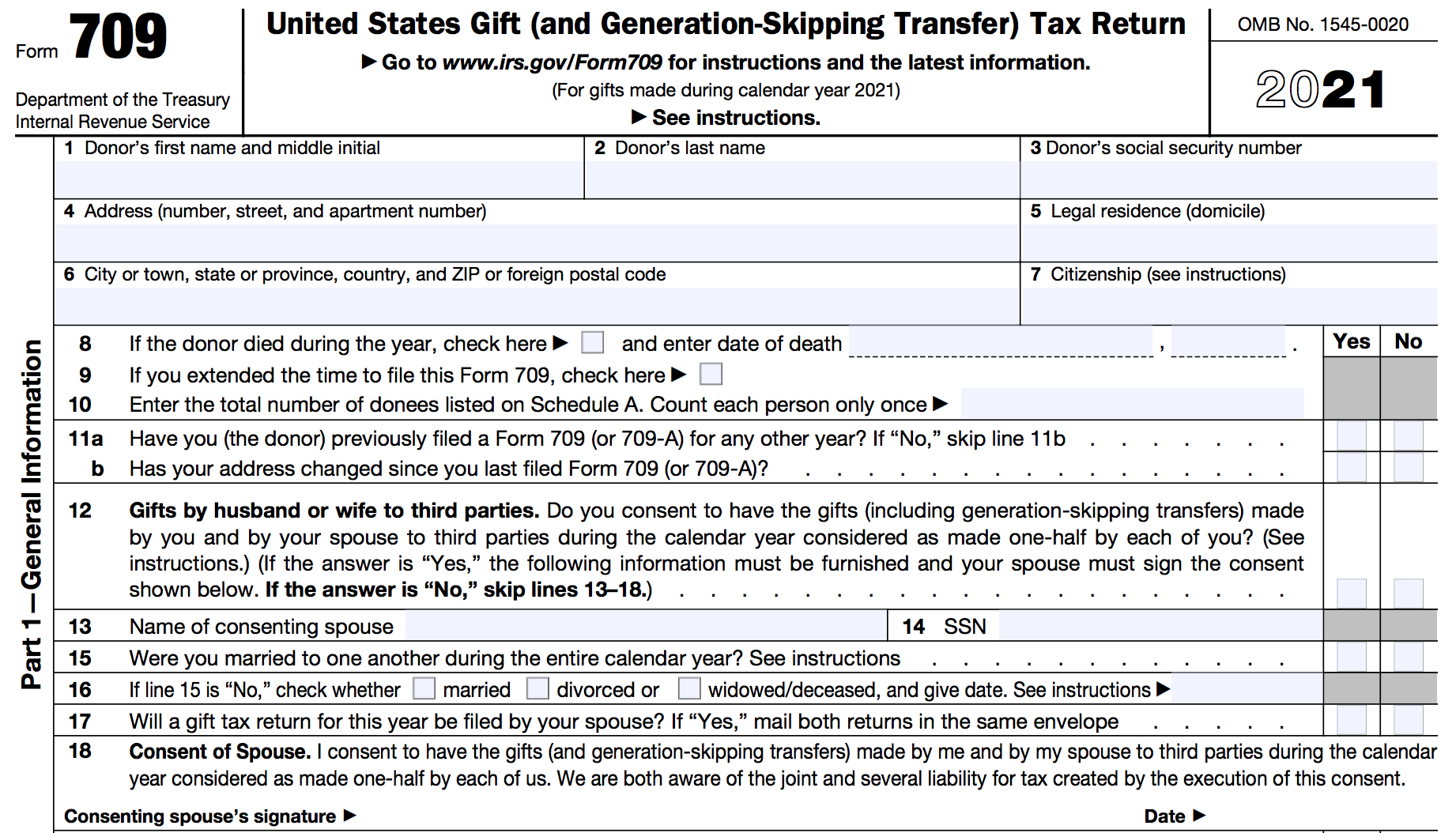

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

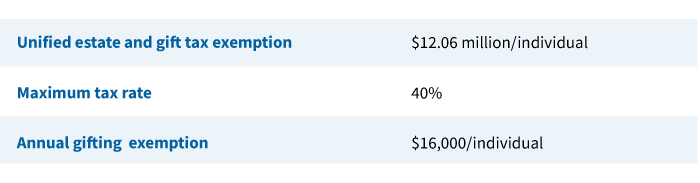

The federal estate tax exclusion is.

. For 2022 the current amounts for each taxpayer are. For 2022 the annual exclusion is 16000. The historical gift tax exclusion amount is not huge but its better than a kick in the shins.

In 2018 2019 2020 and 2021 the annual exclusion is 15000. This is the total amount1206 million for 2022youre able to give away tax. The gift tax exclusion for 2022 is 16000 per recipient.

The estate tax exclusion is the amount that can pass tax-free to a non-spouse upon your death. In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the. The annual exclusion amount will increase for the first time in four years moving from 15000 per person per year to 16000 per recipient for 2022.

Gift tax annual exclusion increases from 15000 to. Annual Gift Tax Exclusion The IRS allows individuals to give away a specific amount of assets or property each year tax-free. Gift tax rules for 2022 onwards.

After four years of being at 15000 the exclusion will be. Estate and Gift Tax Exemption. In 2022 the annual gift tax exemption is.

For 2018 2019 2020 and 2021 the annual exclusion is 15000. The IRS recently announced updates to the annual exclusions for estate tax and gifting for 2022. In addition in 2022 the gift tax annual exclusion amount for gifts to any person other than gifts of future interests to trusts will increase to 16000 while the gift tax annual.

The annual inflation adjustment for federal. In 2022 you can give 16000. The maximum credit allowed for adoptions for tax year.

The annual gift exclusion is applied to. Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. The annual part of the exclusion means you could gift 15000 on December 31 and another 16000 on January 1 without incurring tax because.

What if my spouse and I want to give away property that we own together. A lifetime gift and estate tax exemption amount is available to every taxpayer. In 2022 the annual gift tax exclusion amount is 16000.

How the gift tax is calculated and how the annual gift tax exclusion works. That means you can give up to 1206 million without owing any gift tax. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021.

Gift Tax Annual Exclusion. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021. For the tax year 2022 the lifetime gift tax exemption is 1206 million per person.

This is the amount you can. The lifetime exemption will rise from 117 million to 1206 million in 2022The lifetime exemption would. The publication of this revenue.

5 You can give up to this amount in money or property to any individual per. The amount you can gift to any one person on an annual basis without filing a gift tax return is increasing to 16000 in 2022 the first increase since 2018. The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples.

The annual gift tax exclusion is the amount of money or assets that one person can transfer to another as a gift without incurring a gift tax. For the past four years the annual gift exclusion has been 15000. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each.

1 That means if you had the money. The Internal Revenue Service has announced that the annual gift tax exclusion is increasing next year due to inflation. The federal government imposes a tax on gifts.

The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017. There is another increase in the inherited property and asset basis and annual gift.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Annual Gift Tax Exemption 2022 Video Litherland Kennedy Associates Apc Attorneys At Law

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Wealth Transfer Tax Planning Implications Of The 2017 Tax Act Williams Mullen Jdsupra

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

2022 Income Tax Brackets And The New Ideal Income

Annual Life Time Gift Tax Exemption Simplified Internal Revenue Code Simplified

How Does The Gift Tax Work Personal Finance Club

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Estate Tax In The United States Wikipedia

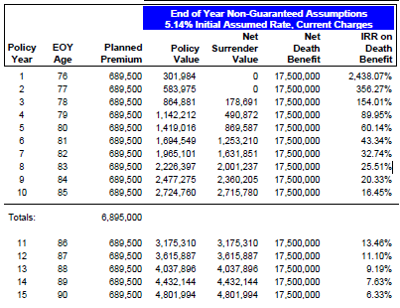

A Simple Solution To The Estate Gift Tax Quandary Agency One

What Is The 2022 Gift Tax Limit Ramseysolutions Com

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Irs Increases Annual Exclusion For Gifts For Calendar Year 2022 Kruggel Lawton Cpas

Irs Announces Higher Estate And Gift Tax Limits For 2021

Four Estate Planning Ideas For 2022 Putnam Wealth Management